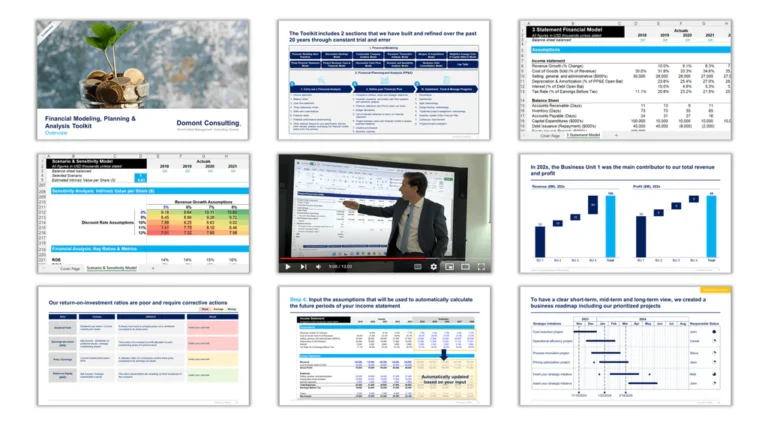

Aurelien Domont Consulting – Personal Finance & Warren Buffett Investing Strategy Toolkit

$990.00 Original price was: $990.00.$55.00Current price is: $55.00.

Aurelien Domont Consulting – Personal Finance & Warren Buffett Investing Strategy Toolkit

In today’s dynamic financial landscape, achieving long-term financial success requires more than just basic budgeting or random investment choices. Aurelien Domont Consulting – Personal Finance & Warren Buffett Investing Strategy Toolkit provides a comprehensive approach that blends practical financial management with the time-tested strategies of Warren Buffett, one of the greatest investors of all time.

This guide is designed to empower individuals and investors to make informed decisions, grow their wealth strategically, and achieve financial freedom. By combining personal finance principles with Buffett’s value investing strategies, Aurelien Domont Consulting offers a structured and reliable path toward financial success.

Understanding Personal Finance in the Modern World

Personal finance is the cornerstone of financial stability. It encompasses budgeting, saving, investing, debt management, and planning for future financial goals. Unfortunately, many individuals underestimate the importance of strategic financial planning, often falling into cycles of overspending, accumulating debt, or making impulsive investment choices.

Aurelien Domont Consulting emphasizes that financial health begins with a solid understanding of one’s income, expenses, liabilities, and long-term objectives. The toolkit equips clients with actionable strategies for managing money efficiently while maintaining a disciplined approach toward wealth creation.

Key Components of Personal Finance

Budgeting and Expense Management

Effective budgeting allows individuals to track income, control spending, and identify opportunities for saving and investing. The toolkit includes practical templates and tools that help create a balanced budget, optimize cash flow, and reduce unnecessary expenditures.Debt Management and Credit Optimization

Debt can either be a tool or a burden. Aurelien Domont Consulting’s approach emphasizes responsible borrowing, prioritizing high-interest debts, and improving credit scores to maximize financial opportunities.Savings and Emergency Funds

Building an emergency fund ensures financial resilience during unforeseen circumstances. The toolkit provides strategies for setting realistic savings goals and creating a safety net that supports long-term financial planning.Investment Planning

Investment is the engine of wealth creation. The toolkit helps clients understand risk tolerance, asset allocation, and portfolio diversification while aligning investment strategies with personal financial goals.

Warren Buffett Investing Principles Explained

Warren Buffett’s investment philosophy has inspired millions worldwide. His strategies focus on long-term growth, value investing, and disciplined decision-making. The toolkit integrates these principles into actionable steps, making them accessible to individual investors.

Core Concepts of Buffett’s Strategy

Value Investing

Buffett advocates buying undervalued stocks with strong fundamentals and holding them for long-term growth. The toolkit teaches clients how to identify companies with competitive advantages, strong earnings potential, and sustainable business models.Long-Term Perspective

Unlike short-term trading, Buffett emphasizes patience and disciplined investing. The toolkit guides investors in creating portfolios with a long-term horizon, minimizing the risks associated with market volatility.Economic Moats and Competitive Advantage

Identifying companies with strong “moats” – unique advantages that protect them from competitors – is a cornerstone of Buffett’s strategy. The toolkit provides practical frameworks for evaluating businesses for investment suitability.Risk Management and Capital Preservation

Buffett prioritizes preserving capital over chasing high returns. The toolkit educates users on strategies to minimize risk, manage market fluctuations, and protect investments.

Integrating Personal Finance with Investment Strategy

One of the unique aspects of Aurelien Domont Consulting – Personal Finance & Warren Buffett Investing Strategy Toolkit is the integration of personal finance management with strategic investing. Many investors fail because they focus solely on investments without understanding their financial baseline. This toolkit bridges that gap.

Steps to Integrate Finance and Investing

Assessing Financial Health

Evaluate income, expenses, liabilities, and savings to determine available capital for investments.Setting Clear Financial Goals

Define short-term, mid-term, and long-term objectives. For instance, retirement planning, wealth accumulation, or passive income generation.Strategic Asset Allocation

Diversify investments across equities, bonds, and alternative assets while following Buffett’s value investing principles.Monitoring and Rebalancing

Regularly review portfolios to align with changing financial goals and market conditions.

Tools and Resources in the Toolkit

The toolkit is not just theoretical; it is a practical, hands-on guide. It includes:

Investment Analysis Templates: Helps analyze stocks using Buffett-inspired valuation techniques.

Financial Planning Worksheets: Track income, expenses, savings, and investments efficiently.

Risk Assessment Tools: Evaluate risk tolerance and optimize investment strategies.

Step-by-Step Guides: Detailed instructions for implementing personal finance and investment plans.

Educational Resources: Articles, case studies, and insights to deepen understanding of wealth management and value investing.

These resources make it easier for individuals at all levels to follow a structured approach toward financial freedom.

Case Studies: Real-Life Application

Several individuals have transformed their financial journeys using principles outlined in this toolkit. For example:

Case Study 1: A mid-career professional reduced debt, created a diversified investment portfolio, and achieved consistent annual returns exceeding market averages.

Case Study 2: A young entrepreneur implemented disciplined savings and value investing strategies, leading to financial independence in under a decade.

These examples highlight that structured planning, when paired with disciplined investing, produces measurable and sustainable results.

Why Choose Aurelien Domont Consulting

Choosing the right guidance is critical. Aurelien Domont Consulting distinguishes itself through:

Expertise: Combining deep knowledge of personal finance with proven investment strategies.

Structured Approach: Step-by-step actionable plans for financial growth.

Tailored Solutions: Customized strategies based on individual goals and risk profiles.

Educational Focus: Empowering clients with knowledge to make informed decisions independently.

Key Takeaways

Financial discipline is the foundation of wealth creation.

Long-term, value-based investing yields sustainable growth.

Integration of personal finance and investment strategies maximizes success.

Using proven tools and resources accelerates financial mastery.

Continuous learning and adaptation are essential for evolving markets.

By adopting the insights and methodologies in the Aurelien Domont Consulting – Personal Finance & Warren Buffett Investing Strategy Toolkit, individuals are equipped to navigate complex financial decisions with confidence and clarity.

Conclusion

Financial freedom is attainable, but it requires discipline, strategy, and reliable guidance. The Aurelien Domont Consulting – Personal Finance & Warren Buffett Investing Strategy Toolkit provides a unique combination of personal finance mastery and investment wisdom inspired by Warren Buffett.

By leveraging this toolkit, individuals can take control of their finances, make informed investment decisions, and build sustainable wealth for the future. It is more than just a resource—it is a roadmap to achieving financial independence and realizing long-term financial goals.